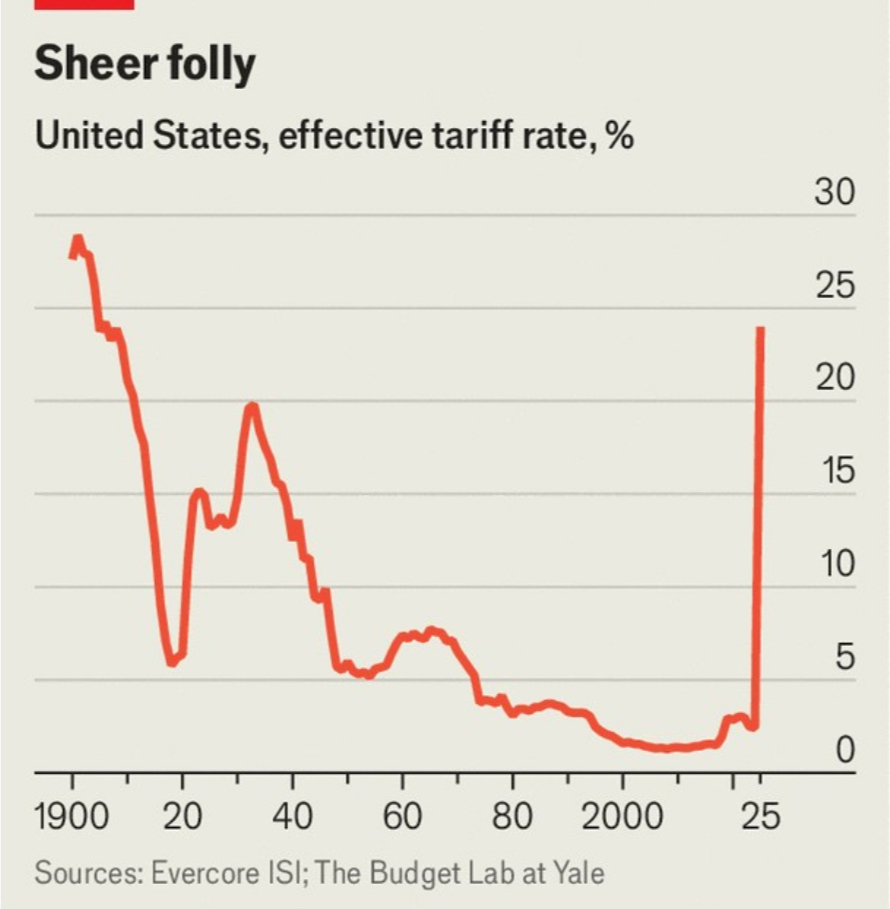

1. The Return of High Tariffs

Source: The Economist

This graph highlights a dramatic increase in the U.S. effective tariff rate, now exceeding 20% for the first time since the pre-WWII era. After decades of trade liberalization, this sharp reversal signals a return to nationalist and protectionist trade strategies, particularly targeting China and other manufacturing hubs.

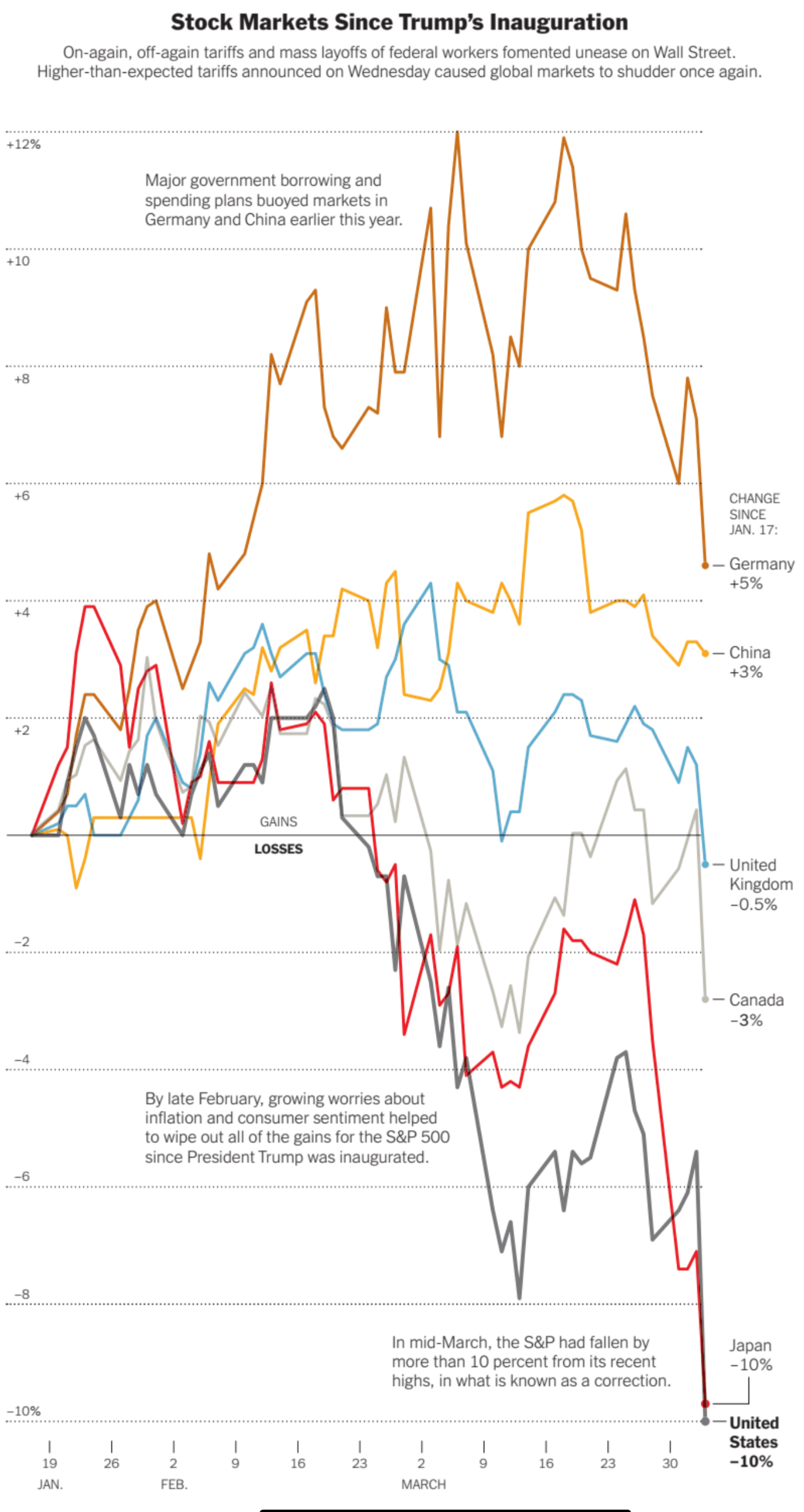

2. Market Reactions: Widespread Volatility

Data from The New York Times depicts how markets responded. The U.S. S&P 500 fell by 10%, while Japan experienced an even steeper drop. In contrast, Germany and China were relatively more resilient due to fiscal stimulus. Investor confidence declined amid fears of retaliatory tariffs and trade disruptions.

Source: The New York Times

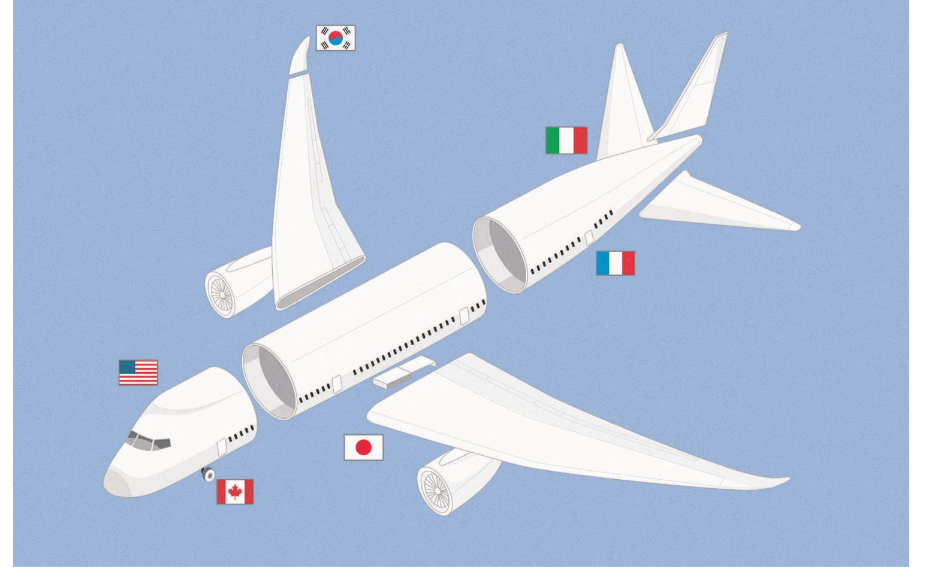

3. Case Study: Boeing and the Broken Supply Chain

Source: The Washington Post

This infographic from The Washington Post highlights the Boeing 787 Dreamliner as a symbol of global manufacturing interdependence. Wings from Japan, fuselage components from Italy, landing gear from Canada, and electronics from South Korea all converge in the U.S. for final assembly. For decades, Boeing benefited from duty-free part imports through international trade pacts—allowing the company to support thousands of U.S. jobs while remaining competitive globally.

However, the imposition of new tariffs on foreign parts risks disrupting this delicate supply chain. Assembling a Dreamliner now becomes more expensive and less efficient, threatening Boeing’s profitability and export competitiveness. More broadly, it illustrates how protectionist policies can backfire on domestic industries by increasing input costs, delaying production, and jeopardizing international contracts.

4. What Should Africa Expect?

- Commodity Demand Volatility: A global slowdown triggered by tariff escalation may reduce demand for oil, metals, and agricultural products, impacting African revenue streams.

- Trade Diversion Opportunities: African producers could benefit if U.S. tariffs divert trade away from China or other Asian exporters. However, this requires swift capacity building and preferential trade agreements.

- Need for Intra-African Trade: The moment underscores the importance of the African Continental Free Trade Area (AfCFTA). Building regional supply chains will reduce reliance on volatile global markets.

- Policy Agility: African policymakers must monitor currency shocks, inflationary pressures, and debt sustainability as external shocks unfold.

5. Energy Sector Shockwaves: Shale Industry Under Pressure

Source: Financial Times

As reported by the Financial Times, the oil price plunge triggered by trade conflicts and oversupply has severely impacted the U.S. shale industry. Prices for U.S. crude fell over 12%, driven by tariff-induced disruptions and OPEC responses. This environment echoes the 2020 oil crash, putting thousands of jobs and drilling operations at risk.

Producers in regions like Texas and North Dakota are seeing declining demand and investor confidence, with warnings that half of U.S. shale companies could disappear if oil prices stay low. This demonstrates the indirect but potent consequences of tariff escalation—where cross-sectoral shocks can emerge in industries seemingly unrelated to international trade policy.

6. Macroeconomic Fallout: Recession Risks and Forecasts

Recent Wall Street Journal forecasts reveal how global economic stressors—including tariffs, inflation, and monetary tightening—are influencing the broader U.S. macroeconomic outlook. The graphs below reflect expert predictions across five key indicators:

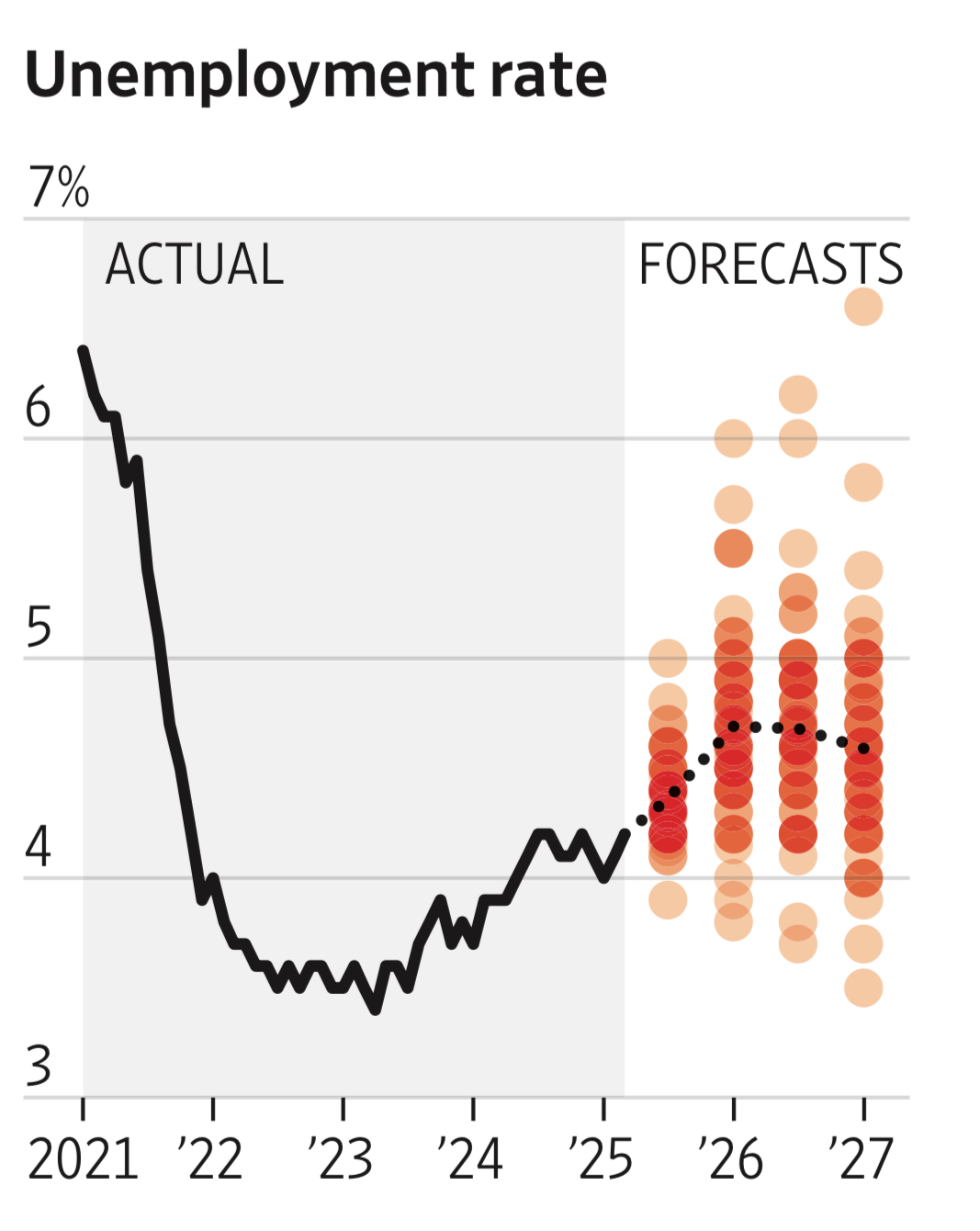

Unemployment Rate Forecast

The unemployment rate, which remained historically low through early 2024, is projected to rise in 2025. This anticipated increase reflects a cooling labor market, as companies implement hiring freezes and layoffs amid uncertainty. While not signaling a crisis-level spike, the upward trend points to weakening business confidence.

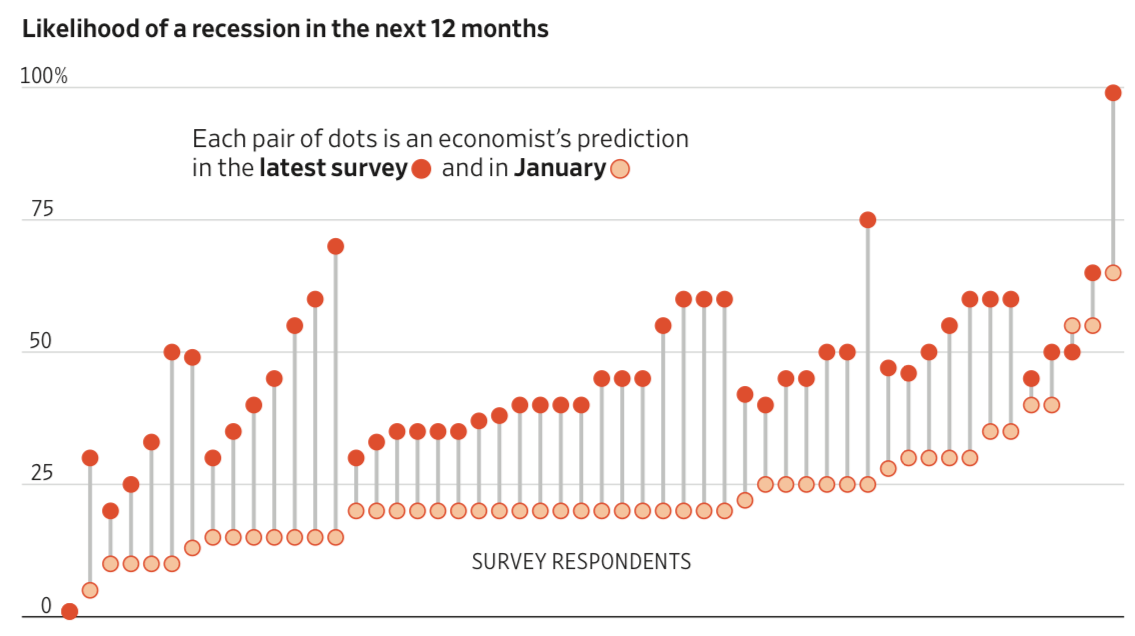

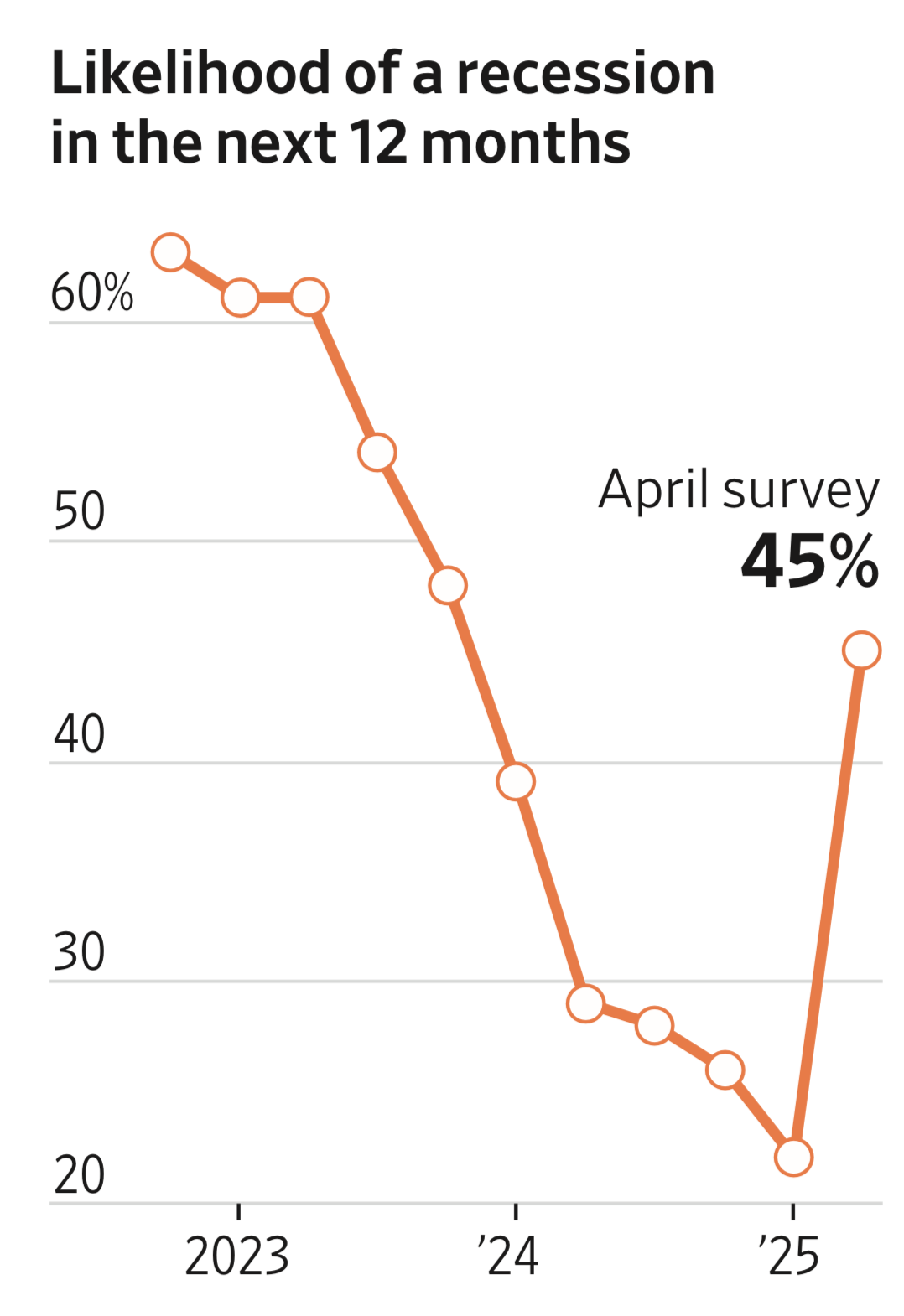

Forecasters now assign a higher probability to a U.S. recession in the next 12 months, with the likelihood approaching 50% according to recent survey averages. This elevated risk is driven by tightening credit conditions, declining consumer sentiment, and fragile global trade dynamics—all exacerbated by retaliatory tariff strategies.

Probability of U.S. Recession

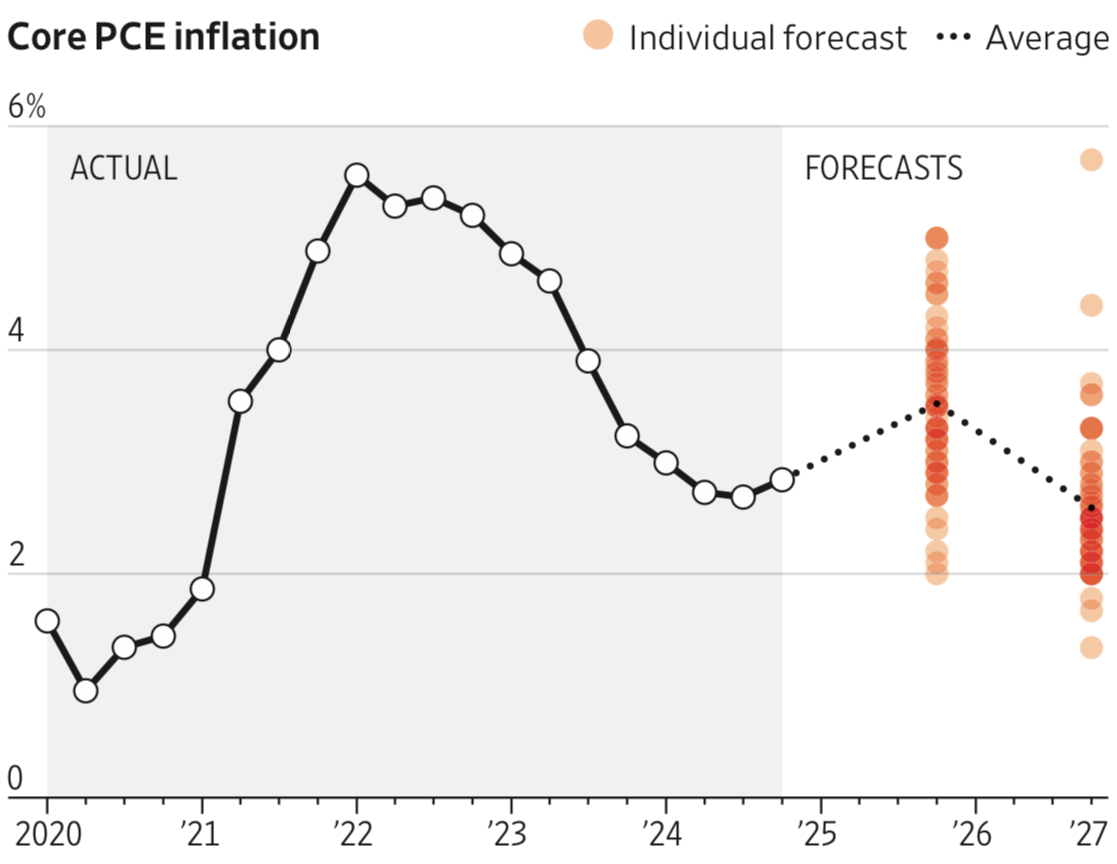

Core Inflation (PCE Index)

Despite aggressive monetary policy actions by the Federal Reserve, core inflation remains sticky. The Personal Consumption Expenditures (PCE) index shows that underlying inflationary pressures are proving persistent, particularly in service sectors. Tariff-induced cost increases may further slow disinflation progress.

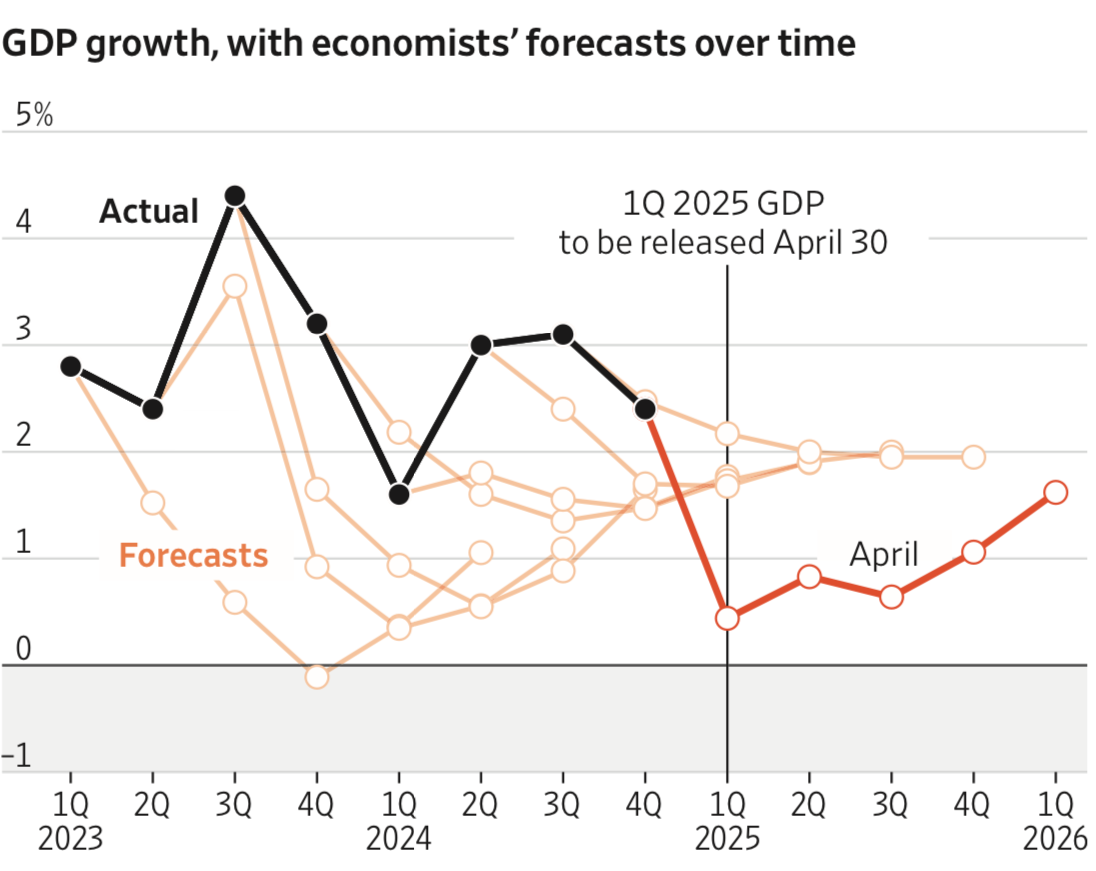

GDP growth projections for 2025 have been revised downward. With investment momentum weakening and exports declining due to global trade frictions, the U.S. economy may struggle to maintain even modest growth. This erosion in output forecasts aligns with broader expectations of a slowing business cycle.

GDP Growth Forecast (YoY)

Rate Hike Expectations

While the Fed has signaled a pause in interest rate increases, market observers remain cautious. Expectations for further hikes are mixed—depending largely on inflation surprises and labor market resilience. The possibility of additional monetary tightening adds to investor unease and financial sector volatility.

Summary: These forecasts present a synchronized warning: the combination of trade protectionism, supply-side inflation, and policy uncertainty has shifted the U.S. economic outlook from cautious optimism to vulnerability. Whether or not a full-blown recession materializes, the trajectory for growth, jobs, and investment is clearly moderating. For Africa and other trade-exposed regions, these signals highlight the urgency of diversification, regional trade integration, and resilience-building measures to buffer against external shocks.